The hottest news in digital health this week? Of all things, a period and pregnancy tracking app.

Flo announced a $1 billion valuation on Tuesday, creating an uproar across our industry and plenty of commentary from insiders. The company also said it raised $200 million to fuel its growth efforts, led by the growth equity investment firm General Atlantic.

The news is important for a few reasons: It’s one of the few companies in women’s health that has made it to the growth stages in tact (Maven Clinic is the other that is perceived by investors as a big success story). And the market has been down in the past few years, meaning we’re all starved for news on big rounds. Given this high valuation, is this a signal that activity is starting to pick back up?

I talked to a bunch of investors yesterday about the round to help me get perspective. Amidst the chatter, I also saw a few important questions pop up repeatedly - so I figured it would be valuable to address those head on:

Why are there two men at the helm of this women’s health company and what does that mean for the industry?

The Flo co-founders are Dmitry and Yuri Gurski, brothers who hail from Belarus. But it’s worth pointing out that the business is far from devoid of powerful women. An early proponent of the app is the Russian model Natalie Vodianova, who invested in Flo and took a board seat (this is a valuable example of how powerful celebrities can be for consumer tech). Not to mention, all the female employees that made this app successful - I’d argue that we too often fixate only on the founders. That said, I do think this is a very legitimate point and worthy of further discussion.

Why is this company worth so much? Does it mean that the market frothy again?

I’d say this is actually a round that appears to be fairly conservative for what we’re seeing in the market today.

Why are so many people using this period tracking app? I thought the space was flooded with competitors?

Flo and Clue are amongst the most popular apps for this use-case. Stardust is also rising star, especially with Gen Z. I’m truly not surprised there’s some standouts in the category for the simple reason that I’m a person who menstruates, and this kind of information is highly valuable. I’m also not surprised that male-led VC firms missed this opportunity hiding in plain sight.

One of the many posts on LinkedIn noting that Flo’s founders are men

So with that in mind, let’s dive into some analysis on why Flo’s valuation is actually right in the range of what we’re seeing in the market today. For that reason, I don’t think it signals that the market is frothy again, although it does confirm that firms still have plenty of dry powder to deploy.

Is this valuation frothy?

To get some good perspective on Flo, I reached out to two friends who deeply understand consumer investing trends: Anarghya Vardhana at Maveron and Aike Ho at ACME. Both have looked at thousands of consumer apps for a potential investment, so they had strong opinions on Flo’s Series C raise.

Per Ho, this is actually a “neutral to positive” announcement, because the valuation multiple is fairly conservative for what she’s seeing in the market for consumer apps.

Assuming Flo has 5 million paid subscribers, as its press release states, and the price point for the app is $59.99 a year… the company realistically is pulling in more than $300 million in revenue. It likely also has other revenue streams beyond subscriptions, and its team told the media that it is exploring areas like menopause to move into next. I could also see the company expanding more deeply into areas like coaching and personalized advice, as well as exploring partnerships with OB/GYN clinics and fertility clinics.

Where the company needs to be careful is the data aspect of the business, particularly given the political climate in the U.S. With women feeling deeply concerned about their reproductive rights, it’s extremely important that this kind of information not fall into the wrong hands. The company has firmly maintained that selling user data is not part of its business model, although there have been investigations in the past related to potential breaches. So it’s continued growth and success relies upon maintaining consumer trust - and I am sure that that aspect is a key risk stipulated in General Atlantic’s investment memo.

Where the company goes from here is a strong focus on growing its paid user base. Ho said that growth investors would be hoping to see a 100% year over year growth rate or as close to that as possible. Leading up to this round, it’s likely that Flo has been growing quickly, or it wouldn’t have achieved such a sizable investment (unless there’s a component to this term sheet that we don’t know about).

“A 3x (revenue) multiple is good, not great (for consumer),” said Ho. “But decent for the market we are in.”

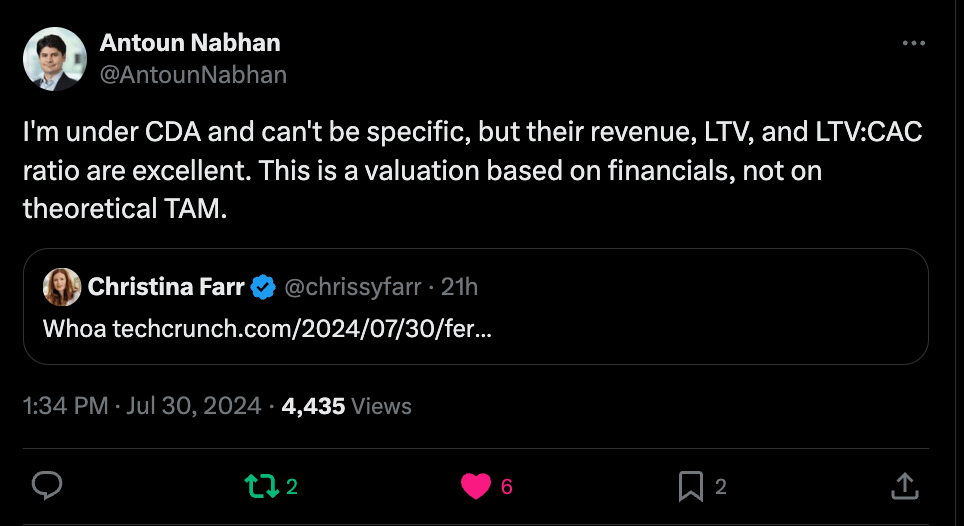

Another growth investor, Antoun Nabhan, said the same thing on Twitter, adding that the company’s LTV and LTV:CAC are “excellent.”

In other words, he thinks that the app is acquiring customers in a way that’s incredibly sustainable and is then keeping them around. That’s the key to making a consumer business successful in the long-run, particularly at a moment when paid marketing has never been more expensive.

The lack of churn doesn’t surprise me, though, given that women have periods for decades of their lives and are eager to understand how hormonal changes impact their mood, stress levels, sleep and so on.

In Vardhana’s view, this is a good sign overall. She made the case that the consumer market has been misunderstood and undervalued for years, particularly because we (falsely) assume that people will not pay for health care out of pocket. That’s increasingly not true, given the rise of high deductible plans and co-pays.

Companies like Hims and Ro have also proven that when a condition is stigmatized, people are more willing to go outside of the system to seek the care and support they need. Period and pregnancy tracking also falls into that area for many women, given that so many do not have a primary care physician or Gyn they can freely talk to about their concerns. One common response from doctors to women trying to get pregnant and struggling? “Book an appointment in a year if you’re still having a hard time.”

So all in, this is yet another proof point for consumer health — and likely it’s a good time for investors to move in!

Is this really a win for women’s health?

Well, this one is complicated given that the founders are men. Things are changing slowly, but it is still an old boys club in venture capital. So it says something that two male founders just raised growth-stage capital in women’s health, when there are so many promising companies led by women. I can totally understand why so many women are feeling disappointed by that outcome.

That said, I’m also of the belief that we need more examples of success to point to in women’s health. Having been in venture capital myself, I know more now about how growth stage investors think. For the most part, they’re looking at the numbers, plugging data into a spreadsheet, and making a financial assessment about how big the business is going to get. Most are underwriting to a 2/3x return on their investment.

The more we see companies like Flo emerge - where a growth stage investor can plug the metrics into Excel and gain confidence in the investment - the better it is for women’s health. There will always be detractors who say there aren’t going to be big winners in this space. But because of companies like Flo and Maven (the latter has a female CEO), there’s more evidence now that this viewpoint is wrong.

So would I have loved to see this business led by a woman? Heck yes. But I’m also ready to congratulate Flo, because this milestone will very likely lead to a trickle down effect of more businesses in women’s health getting funded. And I’m beyond ready for these businesses to get the shot they deserve.

In other news

— I just saw that Spring Health got more funding and is now valued at $3.3 billion! Congrats to April Koh and team. This is super impressive and a fantastic proof point for behavioral health. Now the pressure is on for some companies in this category to I.P.O!

— Second Opinion now has its own podcast!!! We’re live as of this week with our first guest: Parsley Health CEO Robin Berzin. Tune into the first episode here. My co-hosts as biotech/health-tech operators Ash Zenooz and Luba Greenwood. A huge thank you to our sponsor, Awell, the leading careops platform. If you’re interested in getting involved as a sponsor or speaker, please reach out at [email protected].