The biggest winners from the Hinge IPO? Well, according to Second Opinion’s analysis, it’s unsurprisingly CEO and co-founder Daniel Perez, whose stake in the business is worth more than $400 million.

And who else? Investors up to Series C did well. But one firm truly knocked it out of the park: 11.2 Capital. That represents a huge win for a female-led Fund 1 with a small AUM and a thesis to bet on emerging technologies including climate tech and health-tech. 11.2 should not be confused with the Chicago-based venture studio with a similar name.

11.2 Capital made its first bet on Hinge at the seed stage, investing out of a $49 million fund led by managing partner Shelley Zhuang. At the time, Yizhen Dong—now a growth equity investor at Koch Disruptive Technologies—served as a principal at the firm. So it was a team of two people that sourced Hinge Health and did the deal.

A female-led venture firm on its first fund delivered one of the most remarkable returns in the Hinge IPO story.

It appears that 11.2 Capital owns a roughly $200 million stake in Hinge, and its already brought in more than $25 million by selling shares at the IPO. It owns a little more than 5% of the business. Its multiple on invested capital or MOIC? An absolute monster. Paid subscribers can check out our deeper financial analysis and estimates below.

Also notable about 11.2: This small Fund 1 spotted a winner and just kept doubling down, which is the way to do it. 11.2 invested in the seed round in 2016 as part of a $2 million raise (remember when seed rounds use to be this tiny?), and in the $10 million Series A, per Pitchbook. The company continued to invest again in 2020 when Hinge raised a much larger round of $90 million and brought in bigger and more well-known VCs, like Bessemer and Insight. This fund kept following on every chance it could to protect its ownership.

Since the initial Hinge investment, Shelley continues to run 11.2 Capital, per her LinkedIn. And she also runs a new firm called Cannage Capital with Jacob Smith. According to a recent update, she brought her mom to the ringing of the bell for Hinge Health’s IPO.

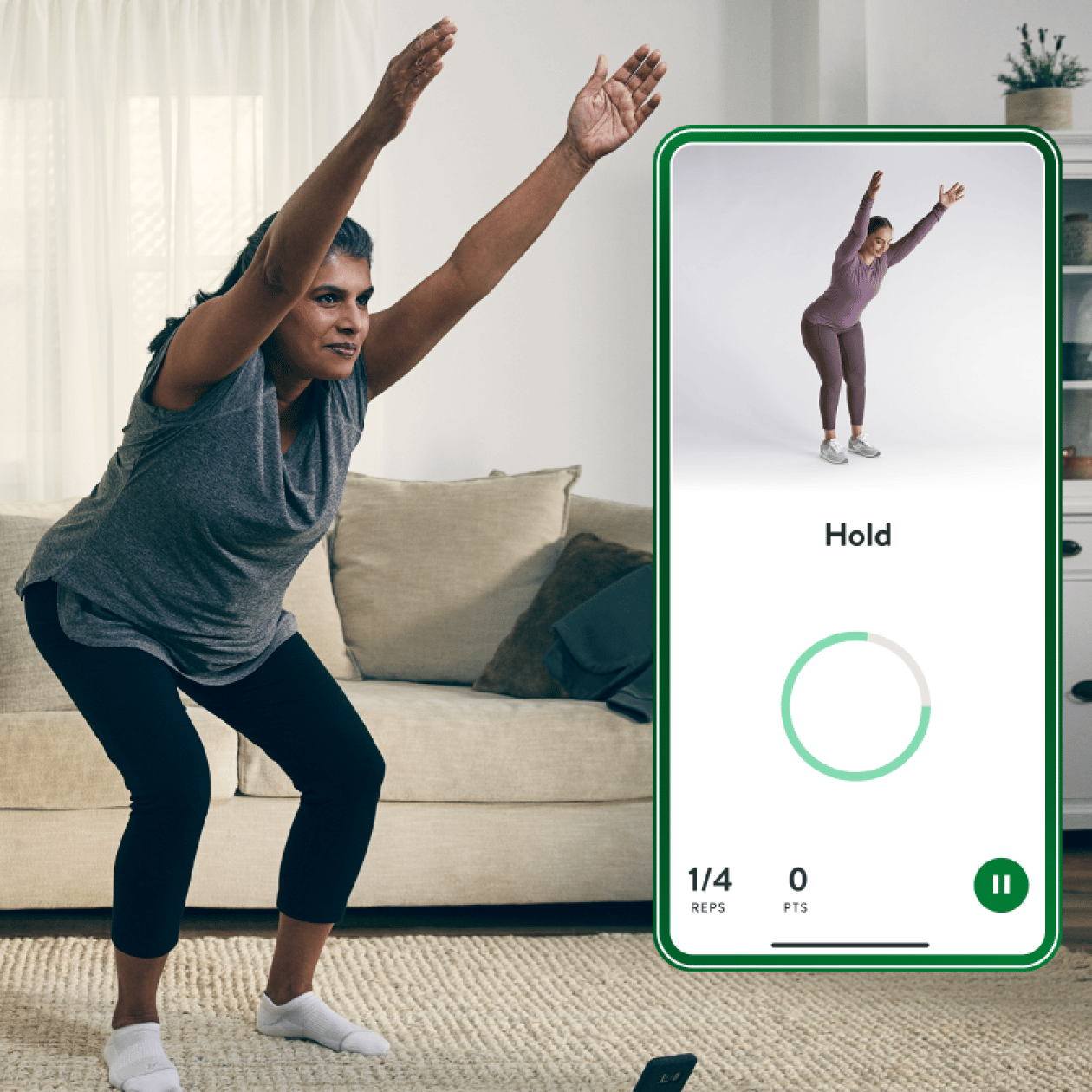

Image via Hinge Health

Here’s the first key takeaway from the Hinge IPO for digital health investors - but with a caveat:

Small funds with modest AUMs can do extremely well in health-tech, but especially when they’re big enough to back their stand out companies and retain a strong ownership position over successive rounds. It’s very important to keep backing winners. Although that’s easier said than done. Hinge may not have been an obvious IPO candidate at the series A or B, and certainly not at the seed.

But also, there’s conventional VC wisdom that indicates 11.2 made a very gutsy decision that many small funds would not have, in favor of diversification. They took an extremely concentrated position into Hinge, given the size of the fund. If it had not paid off as well as it did, that would have been an extremely risky move. Thankfully for them and their LPs, it paid off.

Become a paid supporter to see more

This newsletter is made possible by the paid contributions of users like yourself. Join hundreds of other healthcare professionals, investors, and entrepreneurs that have access to all of our analysis, reporting, opinions and interviews

UpgradeA subscription gets you:

- Subscriber-only posts and full archive

- Post comments and join the community

- Deep dive content and analysis

- Access to remote and in-person events