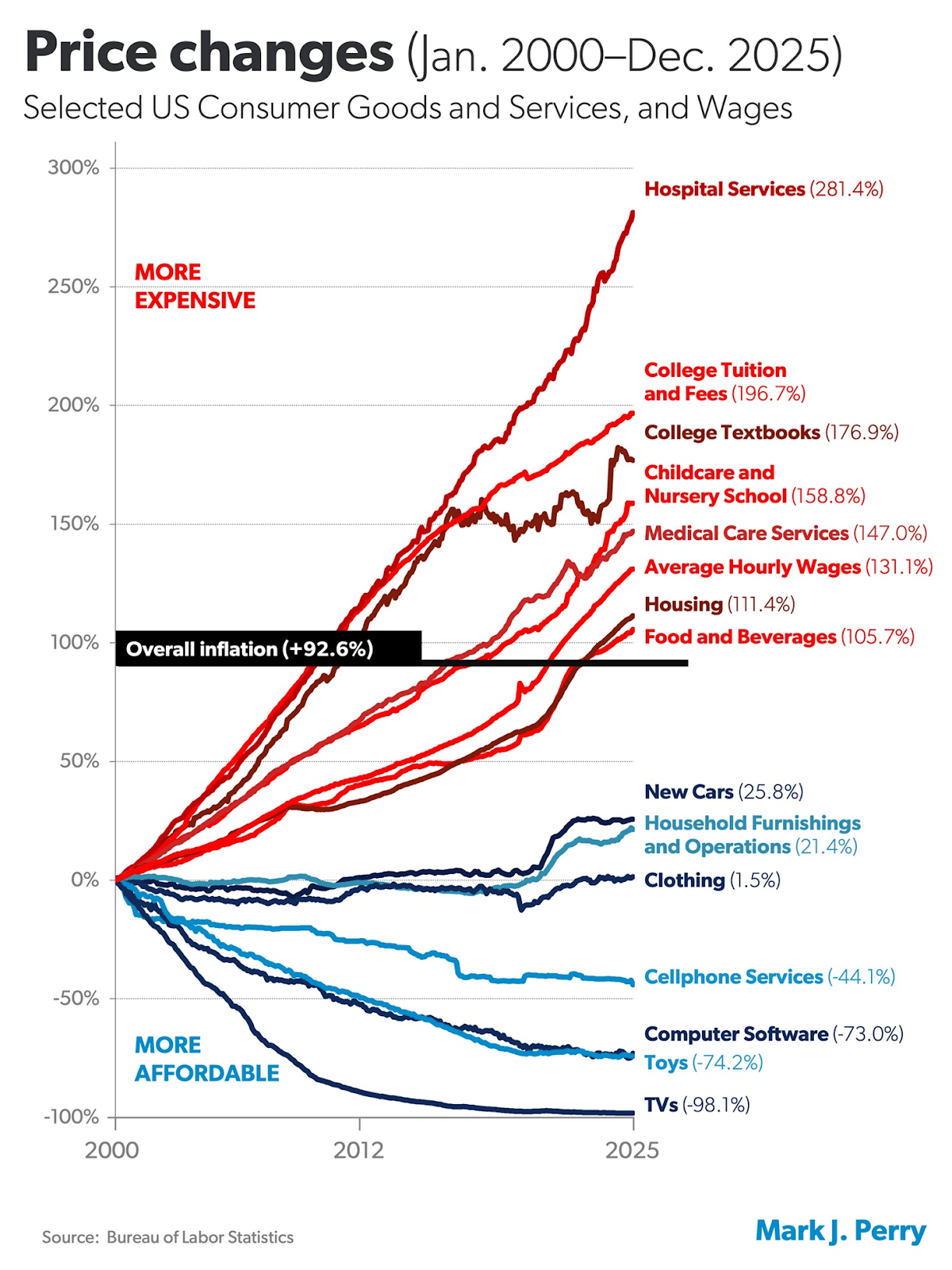

2026 is going to be a year of immense change. A striking visual has been making the rounds on social media showing just how high healthcare costs have become. What was possible to keep under the radar is now out in the open. And consumers have questions.

Just a few that I’ve received from friends who don’t work in the industry but saw this now viral graphic:

If healthcare costs are going up so much, why don’t we have the best healthcare in the world? Fair.

Why is my salary going up, but my take-home pay is flat? Because healthcare is now $27,000 for a family alone.

I could buy a new Sedan every year for the cost of healthcare. So why are my out-of-pocket costs so high? More than 40% of Americans now carry medical debt.

These are all valid concerns. Unfortunately, there has not been a mechanism to rein in spending in our system. And it’s gotten out of control.

As we kick off this new year, consolidation of healthcare systems is driving prices higher, insurers are paying more, and consumers and their employers are footing the bill. For more on the cause and effect, tune into a candid discussion about healthcare prices and potential solutions we hosted on LinkedIn, alongside health policy and industry experts from Imagine 360, Brown University, AT&T, and CBIZ.

In short, for those who missed the webinar, we will have no choice but to try new things. What might be coming down the pike includes steerage and more stringent networks, reference-based pricing, employers teaming up to pool risk, more transparent solutions in the pharmacy space, and a shift to models that only pay vendors for outcomes.

There may be some trade-offs here, but this level of rising cost is not sustainable.

A reminder on upcoming webinars:

Hospitals as the new go-to-market, lessons from the trenches | Mar 3, 2026 12 PM ET | Anyone can sign up here |

News Section Headlines

Biotech is back

The news: Four biotech companies are hitting IPOs in a week, indicating things are looking up for the sector after a rough few quarters, Bloomberg reports.

Some numbers: This is the busiest biotech IPO week of its size since 2021, and follows the slowest year in over a decade. Only eight companies went public in 2025. Altogether, the companies could raise more than $900 million.

Some names: Veradermics, Inc., a hair-restoration company, opened the week on Wednesday, raising $256.3 million. Oncology specialist Eikon Therapeutics Inc was the biggest listing, at $318 million. Eye disease specialist SpyGlass Pharma Inc. raised about $150 million. Belgian immunology company AgomAb Therapeutics raised $212.5 million.

Why it matters: Biotech seems to be in the midst of a turnaround story. This could be the best year for the industry since 2021, according to Stat News.

The GLP-1 Wars Reach Wall Street

The news: Novo said it could see a 13% reduction in sales of GLP-1. Lilly said they will sell 27% more of it. Shares fell and rose accordingly.

Why: Novo was first, so generics are coming. And Lilly was first on direct-to-consumer sales of the product.

What Novo said: The Danish company says this is all expected, if temporarily painful. They are reducing their prices as an investment in the future. “That is our strategy, and we’re going to stick to it.”

Why it matters: As prices continue to drop for this wildly popular class of drugs, we’ll be keeping an eye on how employers respond. Carveouts will become even more popular in 2026, given the growing delta between cash prices and the price for those who use their insurance.

When Healthcare Costs More Than Mortgages

The news: Affordable Care Act marketplace premiums are now so expensive that more and more Americans are having to opt out of having insurance.

How expensive? Very. For a couple in Tennessee, the premium jumped from $250 to $2500. A shopowner in Kentucky saw his deductible go from $750 to $8,450. A South Carolina family realized it would be more expensive to pay their health insurance than their mortgage, and kept only the child covered.

What's next: Over 1.2 million people have canceled insurance, and health crises and consequent personal bankruptcies are more likely to happen.

Why it matters: This will put hospitals deeper into the red as more people will enter into emergency rooms without insurance. Doctors will have to treat those patients, meaning that health systems will have to eat the cost. It’s going to be a rough couple of years until (one can only hope) this all gets figured out.

Carbon Health Filed for Bankruptcy

The news: Primary care provider Carbon Health, which offers hybrid care in 100 clinics and remotely, filed for Chapter 11 bankruptcy relief.

The numbers: Between $100 million and $500 millions in assets and debts. 100,000 creditors.

So they’re closing. No, this is actually a strategy to move on with the business, Carbon says. "The decisive actions we are taking today will strengthen our financial foundation and better position Carbon Health to advance our mission of making high-quality healthcare accessible to everyone," said Kerem Ozkay, Carbon Health CEO, in a statement.

Why it matters: There’s an important lesson or two here for other venture-backed startups, and we’re eager to explore it! Especially given that urgent care tends to be profitable. Stay tuned, and we’ll circle back once the dust settles.

Apple is Shelving a Virtual Health Coaching Service, Per Reports

The news: Bloomberg is citing sources familiar to report that Apple is scaling back plans for an AI-based health service, which was internally known as “Project Mulberry.”

The background: Apple’s health team has undergone a series of personnel changes as its leader, Jeff Williams, retired. Oversight of the health and fitness teams is now shifted to services chief Eddy Cue, who reportedly wasn’t compelled by the idea.

So what are Apple’s big healthcare plans? The company has gone through many phases of its healthcare strategy since Steve Jobs set the wheels in motion before his death. Its plans appear to be more modest these days, inclusive of revamping Siri to better answer health-related questions, according to Bloomberg.

Why it matters: In theory, Apple could do great things in healthcare. But there are downsides to being a publicly traded company with a cash cow like the iPhone. Apple could do everything and anything - so where to focus? And what areas of healthcare are big enough to warrant its attention?

In depth: medicare reimbursement cuts rattle healthcare stocks

Last week, healthcare stocks went tumbling after the government announced its Medicare reimbursement plans. In a LinkedIn live, Second Opinion broke down the news and its repercussions with Chris Ellis from Thatch and Mike Desjadon from Anomaly. Watch it here.

Deals, funding, launches:

$60 million for Chamber Cardio: The startup providing cardiologists with a tech platform for value-based care closed a Series A funding.

$35 million for Lotus Health AI: The free primary care provider has closed a Series A round co-led by CRV and Kleiner Perkins. The startup’s total funding so far is $41 million.

$55 million for Alaffia Health: The claim operations company closed a Series B round led by Transformation Capital. Its total capital raised is at $73 million.

Epic launched its AI scribe: The new feature ambient-listens to doctor visits and drafts notes and summaries. It could cause upheaval in the scribe market.

MultiCare Health System partners with Ambience Healthcare, and the scribing wars heat up: Ambience will provide AI-enabled documentation and workflow support. “We weren’t interested in hype. We wanted proof of technology that could truly help our physicians, APPs, and patients,” said Todd Czartoski, MD, executive vice president and chief physician executive at MultiCare. “Ambience didn’t just perform well; it was the clear favorite among our clinicians. When your front-line staff overwhelmingly chooses a solution because it makes care better and their work easier, that’s where you invest.” That’s certainly a spicy quote!

Lantern strengthens its partnership with UnitedHealth Group: For those who closely follow the employer space, like we do, this news is quietly significant. Lantern has welcomed Specialist Management Solutions to its network and said United Healthcare and Optum have committed to ongoing support in key areas. That’s a bit vague, but it will essentially make it easier for the company to sell to employers to use United Healthcare as their payer. Lantern is in the Centers of Excellence space, focused on high-cost areas like MSK surgeries and infusions, tying its own payment to cost savings opportunities for its employer customers. It competes with players like Transcarent, World Class Health, and Carrum.

Interview with Anita Allemand, PharmD, Chief Growth Officer, Elevance Health

Chief Growth Officer at Elevance Health

1) In healthcare, one of the biggest challenges is navigation. How do you get to the right doctor at the right time? As a pharmacist turned healthcare executive - and now chief growth officer at Elevance Health - how are you thinking about how to solve that problem?

AA: I’ve spent my entire career inside the healthcare system - starting as a pharmacist and moving through pharmacy benefit management into broader healthcare leadership roles. When I think about navigation, it’s from the perspective of the patient and the care team. Leveraging digital technology and AI is not just about efficiency and automation; it’s about making it feel more human. Helping people get to the right care at the right moment means understanding who they are - their preferences, their circumstances, their access barriers - and matching them to services and providers that actually make sense for their lives.

Simplifying an often complex healthcare journey is critical. It must work for patients as well as clinicians. When we reduce friction for providers and care teams, we enable better decision-making, better experiences, and ultimately better outcomes for everyone.

2) What do you see as some of the biggest problems to be solved at this moment:

AA: One of the biggest challenges is health data interoperability. Ensuring the right information is available at the moment it’s needed - at the points of care, prescribing, and decision-making. Providers are often working across fragmented systems and disconnected platforms, and that creates risk and inefficiency.

At Elevance Health, we have a platform called Health OS, which essentially builds pipelines with our providers to make it easier to share data bi-directionally. The goal is simple: make sure clinicians have the right data, in real time, to support patient safety and deliver evidence-based care.

3) What’s your view of the role of AI in healthcare today? Will there be challenges to get adoption amongst providers?

AA: When you think about new technologies and tools, there will always be early adopters and hesitators. We have found that there are large cohorts of providers that are looking for leverage with tools that allow them to spend more time on clinical care. At some point, this will become standard practice. One example I often use is that no one questions why we use spell check anymore. Everyone just uses it, and I think that’s what a lot of these AI tools in healthcare will become.

4) Will there continue to be a human in the loop?

AA: Yes, we view the human in the loop as critical. Tools should be designed to support and assist providers. AI-enabled tools can cut down on time-consuming tasks, so care providers can spend more time with patients. I’m not a practicing provider but believe that offering choice is important. AI should present clinicians with a series of potential options for next steps, backed by evidence-based guidelines. These tools will also become increasingly personalized, considering the patient’s demographic information, cultural differences, and other variables.

From my pharmacy background, I strongly believe that personalizing care matters. When you prescribe a medication, there’s so many factors related to whether a patient takes it or not, related to expense, the potential side effects, and more. Our own digital platforms offer this kind of personalized matching, and we have access to evidence and data to help our members select the care that is most relevant to them when it comes to provider matching and so much more. The goal is to make healthcare simpler, more connected, and more personal, with people at the center of everything we do.

Keep up with Anita Allemand by following her on LinkedIn.

Want to support Second Opinion?

🌟 Leave a review for the Second Opinion Podcast

📧 Share this email with other friends in the healthcare space!

💵 Become a paid subscriber!

📢 Become a sponsor