Whoop goes to battle with FDA

What’s been reported: The U.S. Food and Drug Administration fired off a warning letter to the wearable company Whoop for allegedly promoting its blood pressure feature without notifying the agency and getting clearance. The feature was introduced as part of the most recent hardware launch in May of this year.

What FDA is worried about: That the blood pressure tracking aspect of Whoop means it’s diagnosing, curing, treating or preventing a disease, making it an unregulated medical device. In the warning letter, the FDA noted that messaging to users about the linkage between higher blood pressure and poor sleep is evidence of that. The FDA also emphasized that providing blood pressure estimation is not a low risk function because it’s correlated with a variety of health conditions.

What Whoop said: The company has emphasized that it only offers a single daily estimated range and midpoint, which makes it different from regulated blood pressure monitors. The company’s CEO Will Ahmed took to social media in recent days to emphasize that it’s a wellness feature only, and that it is clearly not labelled for medical use. “It does not diagnose any medical condition,” he wrote on his personal LinkedIn, and stressed that users have to go through an onboarding process to ensure they know that it’s not intended for that purpose.

Our POV: We have seen very mixed views from Whoop users and physicians, some highly supportive of Whoop because of the wellness aspect of the feature and others siding with FDA because they view blood pressure as higher risk (the warning letter is actually worth a read on that front to get a sense of the nuance). What interests us is the timing of all this, given that this administration seems to be quite vocal - and particularly Health and Human Services Secretary Robert F. Kennedy Jr. - about wanting to get behind the proliferation of wearables. What this comes down to is whether or not what Whoop is doing is truly wellness. As I spoke to experts on this, one thing to consider is that regulators have been consistent that a feature that provides systolic and diastolic blood pressure with cuff calibration is considered a medical device, so allowing Whoop to continue with it means setting a new precedent for the FDA. But as Whoop user and Geisinger executive Dr. Jonathan Slotkin tweeted, Congress has carved out wellness software because health metrics are useful long before they reach the level of a medical diagnosis. So it’s complicated! I’ll be eager to see how it pans out.

Hims & Hers will expand to Canada in 2026

What’s been reported: Following its acquisition of European digital health platform ZAVA, Hims & Hers announced its plans to enter the Canadian market in the coming year. The company, fresh from a breakup with Novo Nordisk in the US, and plans to get a slice of the Danish company’s market in Canada, where its patent is set to expire in 2026, leading to the world’s first available generic semaglutide.

A big size market: An estimated two-thirds of Canadians are overweight or obese, and a potential customer base. Currently, branded semaglutide is available from about C$200, exclusive of clinical support costs. The generic is expected to be about half the price.

What Hims & Hers said: “Canada is a major opportunity to show what affordable, high-quality weight loss care can look like,” said Andrew Dudum, co-founder and CEO of Hims & Hers.

Our POV: The Canadian healthcare system looks very different from the U.S., namely because Canada is mostly single payer and publicly funded. I’ve been reading that coverage for the GLP-1 medications continues to rise in Canada, and that Canadians may be able to access more affordable versions of the drug as soon as 2026. But I also texted a few friends in Canada to ask about this, and they mentioned a few homegrown competitors like Felix Health that may give Hims & Hers a run for its money. One fascinating point that came up more than once: Some patients in Canada are afraid to work with online direct-to-consumer players to get a GLP-1 prescription, because they fear their family doctors will find out about it and drop them from their patient panel. And it is so hard to get a good family doctor! I found that fascinating, particularly as there’s growing evidence showing that a third of Americans don’t even have a family doctor, and that younger generations increasingly aren’t seeking one out.

Rush University health system partners with Fabric for digital care

The news: Chicago’s Rush University health system is partnering with Fabric, a company that builds products that make it easier for hospital networks to coordinate patient care. The company builds products for clinicians (clinical decision support, documentation, symptom collection) and for consumers (patient intake form, symptom tracking, and so on). Via this relationship, patients will be able to access Rush network care remotely, with AI guiding them through providers and treatment plans.

What’s in it for Rush: Like many other health networks, Rush is preparing for a near future (aka, present) when it won’t have the workforce to serve its potential population. AI-enabled remote access promises to streamline access frees up in-person care capacity.

Our POV: We have seen companies sprout up that do each of the product features that Fabric offers, and view that as a beachhead to a broader platform. These companies have historically raised less money than Fabric has (it announced a $60 million round led by General Catalyst in 2024). What will be interesting to watch over time is if Fabric has an edge in health system sales relationships because of its broader product suite, and if it is forced to grapple with a lot of the customization-related requests that have plagued digital health companies in the past.

Best Buy Health plans layoffs

The news: Best Buy Health is laying off 161 employees, effective September 12. The workforce reduction follows the company’s divesting from Current Health, which it had acquired in 2021 and sold back to its cofounder, Christopher McGhee.

What we know: Best Buy Health has been less than profitable for the company. In the first quarter, the company reported $109 million of expenses to restructure its health unit. And before, it reported a non-cash goodwill impairment charge of $475 million, Healthcare Drive reported.

Our POV: Hospital at home has always been a question mark for a lot of health industry experts in our network, mostly because people who are in hospitals do often typically need to be there. As one industry friend pointed out by text, as we discussed this news, hospice at home makes all the sense in the world, as people who are dying and want both comfort and pain relief almost never want to be in hospitals. But those who are critically ill, and in need of a fast intervention as things decline, often need the kind of care that can only be administered in a hospital. That said, there have been some compelling studies showing that Hospital at Home can work on the right subset of patients without jeopardizing outcomes. But practical implementations of these solutions have been hindered for other reasons, including staffing shortages and a lack of clear reimbursement for Hospital at Home programs.

Zyter|TruCare hires new CEO

The news: Digital health provider Zyter|TruCare hired Sundar Subramanian as its CEO, Fierce Healthcare reported. Subramanian hails from PwC, where he worked on strategy with a focus on healthcare business.

What’s the deal: The large healthcare IT vendor, which covers more than 40 million members across 45 health plans, is betting on — you guessed it — AI. The new CEO will be tasked to tailor the company’s offering to its upcoming AI products, which are promoted as cutting administrative burden in half.

What to expect: Subramanian is aware that technological advancements often don’t lead to better results, and is focused on ensuring his tenure at Zyter|TruCare doesn’t end up in a layering of more advanced products that make little difference.

Expert POV: Agentic AI is super hot right now, and as Subramanian points out, it’s a requirement that this technology truly fit into the workflow of existing systems. What the challenge will be, in our opinion, is in the differentiation. This space is already thick with venture-backed competition. One outcome that’s been pondered? Deep disruption to prior authorization as it stands today, because AI agents on both sides of the issue won’t back down like humans often eventually do.

What will Medicaid-focused startups do with the one big beautiful bill?

The news: In the 2020s, a lot of venture-backed startups started courting Medicaid markets, with their biggest 10 raising about $1.5 billion as of 2023. Now, with $1 trillion cuts on the horizons, their destiny is an open question, Axios reports.

What is going on: Some startups have already seen paused payer contracts, which will push some companies to pivot to different markets. There aren’t a lot of markets out there with a size comparable with Medicaid, so this could be one of the areas showing how much wealth is being built on the back of services provided to lower-income people.

The exception: Some CEOs see an opportunity in cost-cutting and integration through — yes — AI.

Expert POV: Investors do tend to get very nervous when there’s policy-related changes that could put a potential investment in a tough spot. I had lunch with Town Hall Ventures’ David Whelan this week, and we talked about investment trends and the appetite in Medicaid specifically. He said it requires nuanced thinking from VCs as some companies are poised to succeed in this policy environment, like Fortuna Health, which will stand out in an environment where plans need to verify eligibility and stabilize risk pools. Companies that target Medicaid populations in areas like pediatric and behavioral health (he cited his own firm’s portfolio companies Marble Health and Playground Pediatrics) will likely see little change in enrollment. And may actually see material upside if they offer more efficient and effective models. But it’s that very nuance that may also pose headwinds, even as there are policy tailwinds. Not all investors will take the time to dig in.

Major funding announcements and deals

Lyra buys Bend Health

This acquisition makes all the sense in the world, as it will help Lyra get an edge in a competitive behavioral health landscape through a Bend-branded pediatrics product (interestingly, Bend will keep both its team and its name). There’s still a lot of demand for behavioral treatment for kids, and Bend has a strong network of health plan contracts, 50-state coverage, plus an experienced team. We predict far more M&A on the horizon of this variety: Namely larger digital health companies buying smaller ones for deeply strategic reasons.

$60 million for Phil

Drug commercialization company Phil secured $60 in debt growth financing from K2 HealthVentures. The goal of the financing is primarily to accelerate AI integration across the platform.

$4.5 million for Plexāā

Plexāā, a UK-based medtech startup, closed a $4.5 funding round. The funds will support the US launch of Bloom, a wearable device that helps cancer patients prepare for reconstructive breast surgery by preconditioning the skin to reduce the risk of complications.

$55 million for Vytalize Health

Practice management company Vytalize Health raised $55 million in additional funding, bringing its total funding to more than $230 million. The company helps independent physicians and health providers transition toward value-based care models.

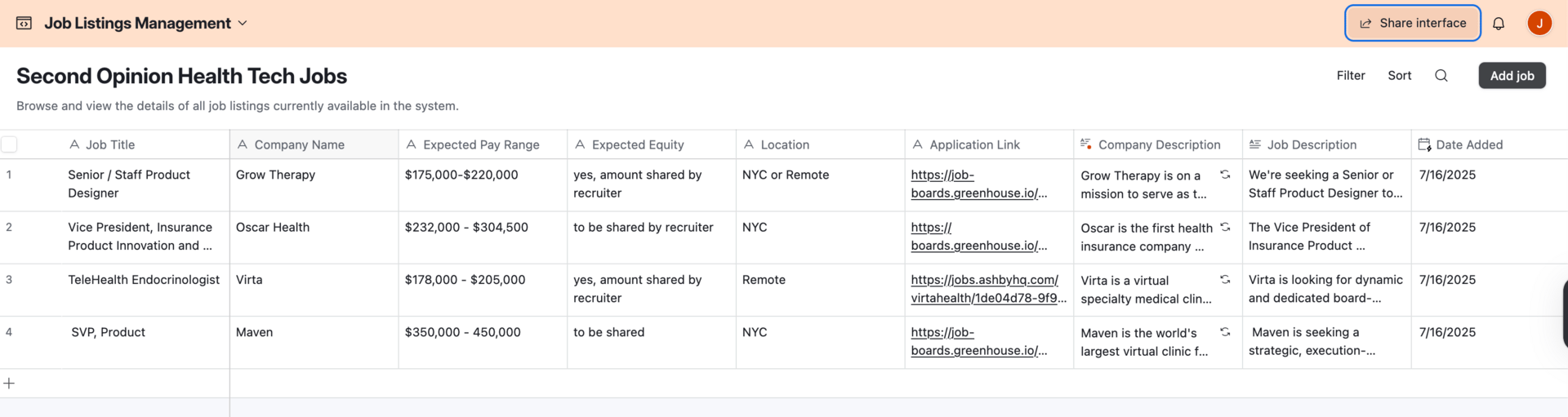

Featured Jobs and Founder Dating

We’re adding a free job board for the Second Opinion audience. Visit this link to add a job and go here if you want to see what else is posted (it’s new, so still fairly empty). We’d love to hear about your interesting roles.

We’re also interested to find ways to connect help founders find each other, or connect people to advisors. Click here to join the network and share what you’re looking for

Jobs

Fast-growing behavioral health startup Grow Therapy is looking for a product designer responsible for developing products and experiences for its therapy providers. Grow has a strong presence in NYC but the role is listed as USA, so the company appears to be open to a remote hire with more than 5 years of professional experience.

Virta Health has a bunch of clinical roles open, including a few for telehealth endocrinologists. Per the job listing, this person must have more than one state license, and be well versed in how to practice medicine in a virtual setting.

Welldoc is hiring a director-level person to run its digital marketing ecosystem, and the ideal person is hands on, collaborative and has a proven background in healthcare marketing.

Maven is hiring for an SVP of Product. Reporting to the Chief Product & Operating Officer, they’re looking for someone with deep experience in workflow focused SaaS platforms.

Four Question with Julia Bernstein - COO at Brightside Health

by Rebecca Mitchell

Julia Bernstein, COO at Brightside Health

Digital health companies go through "generations" as technology, regulation, markets, and consumer behaviors shape shift. As an operator who has worked across several generations at Thirty Madison and now as a leader at Brightside, what are 2-3 changes in how digital health companies are being built in this generation beyond "focusing on profitability and AI"?

JB: I love that we have now been building digital health companies long enough to talk about generations.

My first thought is that much of what used to be hard in the first few years of building health tech companies has been standardized, commodified, or productized. For instance, setting up a professional corporation structure is now a well-traveled path, versus the first time I did it in 2019. Similarly, finding a good EHR or the components needed to assemble one is much easier today than it was in 2014.

The flipside to this is that it is also much easier to build things today than it was five years ago. The core question is now often no longer how to do something but which layers of the stack you need to own to create enterprise value and better patient outcomes. It’s now an own vs. buy decision instead of defaulting to building. AI has only accelerated this conversation and the tradeoffs.

The final thing is that commercial strategies keep cycling. In the early 2010s, no one believed consumers would pay for care, so startups focused on vendor-based employer sales. In the mid 2010s, there was a pivot towards trying to work more directly with health plans so that care was covered under the medical benefit. COVID helped drive a dual strategy of going DTC while getting FFS payor contracts. And now we’re all focused on using those FFS footholds to build deeper, potentially risk-bearing, payor partnerships. I know at least four companies running executive searches focused squarely on health-plan relationship builders.

Lets flip the question - what lessons did we learn in the last generation that are still valid today? For example, I have many friends at Hinge who say they sharpened their pencils on what worked in the Livongo product and G2M playbook to drive their success, regardless of the Teladoc M+A write downs.

JB: A few things come to mind.

Make it easy for customers to buy. When you’re first to market with a new product or payment model, buyers may not know how to pitch you to their internal stakeholders or how to configure their system to pay you. Good collateral, an understanding of the buyer’s hurdles, and a clear path to signature remain essential.

Balance speed with quality. In healthcare more than any other tech domain, we need to balance getting things to market faster with doing things the right way. Safety and quality systems are paramount, as racing to commercialization can create risks. This is an area that requires attention and, often, serious resourcing.

Flawless implementation wins renewals. While most of my experience is in care delivery, Ginger.io actually started as a software platform. After a decade of implementing (and being the first user of) many healthcare SaaS tools, the ones I still use are those that set us up for success early and managed our expectations throughout. This might also mean starting with a smaller cohort of customers - it’s hard to come back from early reputational issues.

Get into the user’s workflow on Day 1. Early digital-health vendors sold in the wake of Meaningful Use, when EHRs were closed systems. Integration options are better now, but embedding in clinicians’ or employers’ existing tools is still the best way to reduce friction.

Publish the evidence. Buyers—especially payors and health systems—continue to ask for peer-reviewed outcomes and real-world evidence. Building an early habit of rigorous data collection and publication is no longer a competitive moat but is tablestakes, especially as we see more pay-for-performance

You are also an active angel investor. As a former operator myself, an early stage investing trope that always strikes me as silly is this idea that there is no data when investing very early - as if operators make decisions with no data until a business is growth stage! I don't think so. As an operator, what do you look for when investing very early? How do you advise other operators to lean into their unique strengths when assessing for early stage signal?

JB: I sometimes joke that my primary filter for angel investing is a clear answer to how will you get paid? My second question is how you will acquire customers? These are essential whether a company’s go-to-market is B2B, DTC, or B2B2C. And then I dig into other fundamentals like the actual problem, the TAM, and expected unit economics. Founders who know the answers usually have early signals—LOIs, pilots, or consumer metrics.

Beyond that, I look at the founder(s), how they arrived at the idea, how committed they are, and will they ask for help when they need it? I evaluate the company’s early pain points to see if my experience is relevant. I also try to do a quick regulatory and compliance analysis to make sure there aren’t hidden risks. I invest where I can add value—say, advising on FFS payor contracts or selecting the insurance-tech stack—so my money works harder and I stay sharp as an operator.

For operators interested in angel investing, a first step is defining your investment focus and your competitive advantage. What expertise have you picked up in your day job that makes you uniquely positioned to invest? Are you drawn to sectors outside your day-to-day work, or are you best positioned to invest in companies that are in or adjacent to your current space? One low stakes way to begin is by evaluating early-stage vendors who pitch you through this lens—ask yourself whether you’d invest based on your experience as a buyer or user.

Behavioral health went through a moment in the pandemic and attracted a lot of funding, even relative to other areas of digital health. There seems to be collision approaching between at scale platforms built during the pandemic, and newer best in class point solutions that have grown fast since. How do these two approaches co-exist? Does the platform start to lose market share? Does the point solution get stuck?

JB: If I could truly predict this, I’d be a growth investor. Having seen a few cycles of shifting behavioral health business models, I believe this isn’t a winner-take-all market—digitally or in brick-and-mortar.

For me, navigation is now as critical as the services themselves. At Brightside, we aim to be the most comprehensive virtual provider for moderate-to-severe conditions, supported by robust care coordination. Many digital point solutions are already bi-directional referral partners, and we’re beginning to work with other platforms as well. I expect continued integration and selective consolidation rather than a single knock-out victor as the market continues to evolve.

Do you believe that clinical teams should be built so that the business problems are their responsibility as much as the clinical problems? Why or why not? What ripple effects does this have across the organization, from the construction of teams, to culture, to the ultimate success of the business?

JB: Legally, the professional-corporation / MSO split protects clinician independence—a principle I support. Culturally, transparent alignment on business goals is critical, especially as outcome-based reimbursement becomes more common. Care quality should be a business imperative, and shared metrics drive success. I’ve been fortunate to partner with many great clinical leaders who have been in private practice and understand the complex ecosystem in which we work. Brightside’s co-founder and CMO, Dr. Mimi Winsberg, who embodies both clinical excellence and startup pragmatism, is a great example of a leader who looks at how the care delivery model supports continued growth and impact.

Want to support Second Opinion?

🌟 Leave a review for the Second Opinion Podcast

📧 Share this email with other friends in the healthcare space!

💵 Become a paid subscriber!

📢 Become a sponsor