TLDR:

$54B preventative oral health market (inside of a 300b+ oral care market) but it receives <1% of VC funding in 2024

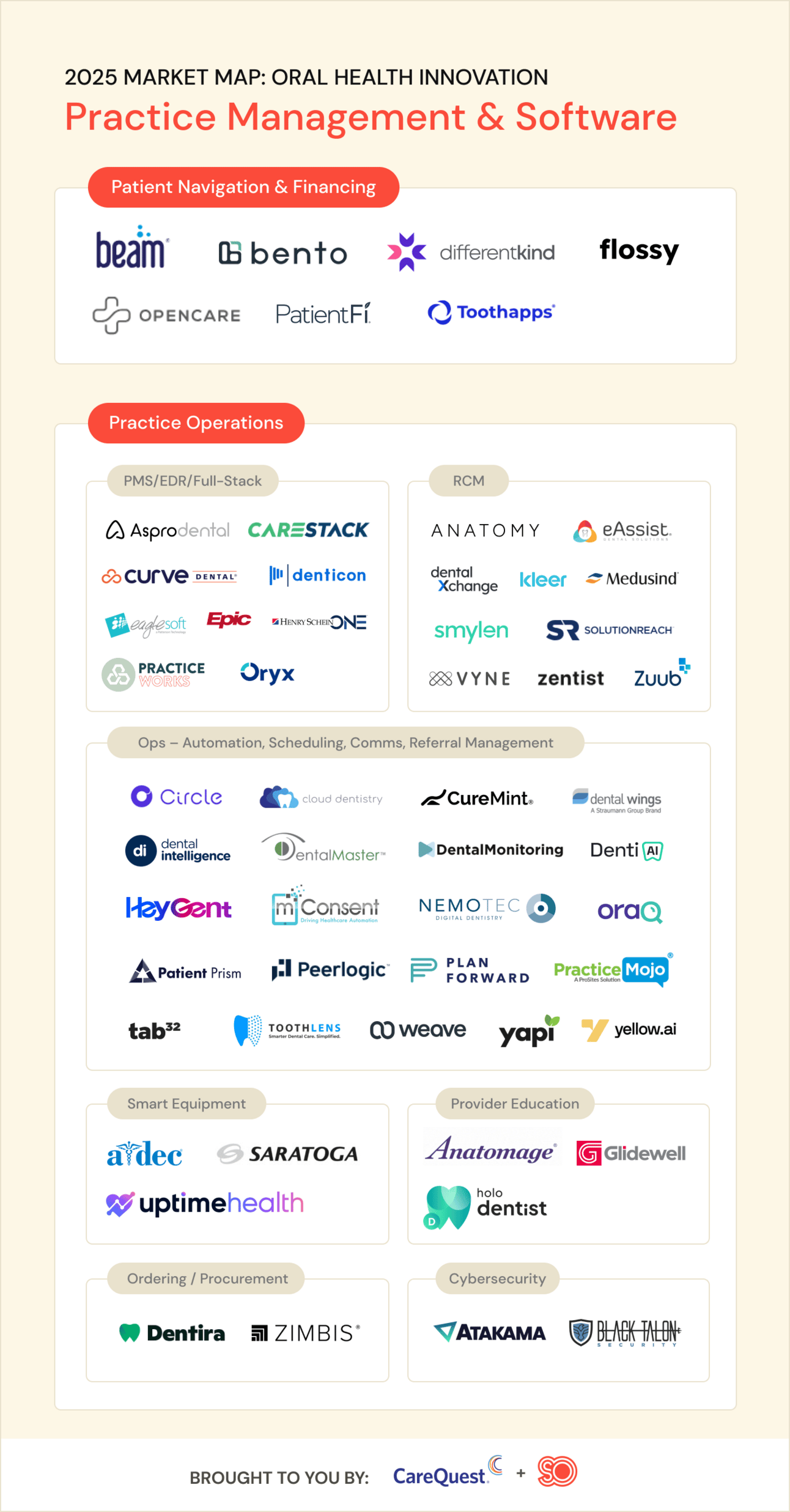

Massive gaps in access, coverage, and prevention, and there’s a market map included to guide investors toward high-upside bets

Private-equity driven practice consolidation enable software sales at scale—new GTM paths emerging

Undercapitalized areas:

Practice management (no dominant EHR)

Patient financing & navigation

Preventive tools & diagnostics

When I was growing up, one of the ways I got diagnosed with chronic sinusitis - and ultimately on a path to get surgery - was at the dentist. My provider saw that I was doing a lot of mouth breathing while sleeping, so referred me immediately to an ears, nose and throat specialist for a follow-up consultation. I didn’t recognize it then, but this was my first foray into the broader arena of “oral health” versus dentistry. I’d associated visits to the dental office with screenings, cleanings, and the odd filling or cavity. Check the gums and teeth, take home the floss and a toothbrush, rinse and repeat. As it turns out, the dentist office can be so much more than that, particularly as fewer Americans than ever have a longitudinal relationship with a family physician and instead treat the emergency room as their first stop for healthcare.

What Your Mouth Says About Your Health

The mouth may not be a window into the soul, but it does provide a lot of information about a patient’s current and future health, and even their socioeconomic circumstances. Whether it’s the teeth, the gums, or even the jaw, researchers have found strong links to all sorts of health conditions ranging from neurological disease, diabetes, heart disease, and even pregnancy. There’s also disparities in oral health outcomes amongst kids and adults that are fully addressable and preventable. These inequities are getting worse every year. A CDC study found that from 2016 to 2021, there was a 10% decrease in low-income children and adolescents opting in for routine dental visits. In rural areas, studies are finding that between 30 and 40% of people aren’t getting routine dental care. During Covid, many people opted against dental work and check-ups. That could serve to increase these disparities in the next decade, particularly as we face a potential future where even fewer people in America have access to dental coverage.

Avoidance is costly

For millions of people, dental care involves some level of out-of-pocket expense - so many avoid it for as long as possible. A recent report found that about 72 million people don’t have dental insurance, and that number is set to increase. One result is that patients don’t seek preventative care, leading to trips to the hospital when acute dental conditions arise. “In 2021 alone, Americans made more than 2 million costly visits to the emergency room for dental-related issues, most of which could have been prevented with timely, routine care,” Melissa Burroughs, senior director of public policy at CareQuest Institute for Oral Health told me. That’s adding enormous costs to an already burdened healthcare system.

We’re not headed in the right direction. Burroughs is extremely concerned about possible cuts to adult dental coverage from Medicaid, which she fears could result in $1.9 billion in added healthcare costs as more people choose expensive hospital visits over inexpensive preventative care. This is also a drain on productivity, given how many days off of work are required for dental emergencies, and it can be incredibly painful and traumatic for patients. An astonishing 50 to 80% of U.S. adults have reported some form of dental anxiety, per a 2020 study in the Journal of Dental Hygiene. Kicking the can down the road by avoiding the dentist won’t help, as it’ll more likely lead to the need for painful dental work in the future.

In light of that, health systems, self-insured employers and health plans are starting to pay attention to the problem, viewing better oral health as a key pillar in the strategy to avoid expensive outcomes and reduce costs. For that reason, in 2025, I predict oral health will be an increasing focus for investors, public health, and health plans. There’s a small but growing number of investors wholly dedicated to oral health, such as Dental Innovation Alliance, CareQuest Innovation Partners, Revere Partners, and 4100 DX; corporate venture firms are leaning in, and more health care and even consumer firms are paying attention at all stages from seed through growth. There’s also an accelerator for oral health startups run by CareQuest Innovation Partners, called SMILE Health.

The analysis continues below for all users who are on our mailing list…

Why Investors Should Pay Attention

Oral health is an extremely large market - estimated to be $54 billion - and yet only about 0.8% of venture dollars were allocated to this opportunity in 2024. And yet, the market is getting larger every year. By 2030, one study indicated that dental-related spending for OECD countries could surpass $430 billion.

“It’s a little crazy, when you think about it, that an opportunity that impacts 3.5 billion people could attract such little venture investment,” said Katie D’Amico, vice president of growth and innovation at CareQuest Innovation Partners. CareQuest is focused on the problem across a few different dimensions, including through its nonprofit arm, via impact investing, its accelerator program for early-stage startups, and partnering on pilots integrating medical-dental care. CareQuest, a sponsor of this piece, agreed to collaborate with Second Opinion on a market map so that investors interested in this space could get a head start. D’Amico said she sees big opportunities in technology & AI, to expand access to care for especially for underserved pediatric, populations, and pregnant women, and in connecting medical-dental data and care through products and services that reach people wherever they are, whether their dentist, primary care doctor, OB-GYN, or even at home. My personal view is that there will likely also be more workflow tools for this space, particularly given that dentists face many of the same burnout-related issues as physicians and other medical professionals, and documentation is a major burden. The key, as we describe below, will be to connect and integrate all the different point solutions.

Where the Opportunities Are

Via the market maps we’ve created (which you can download above, or see below these paragraphs), it’s clear that some of the most under-invested in areas include:

Practice management solutions for dental offices that integrate with medical and the growing number of software point solutions. Notably there isn’t a dominant EHR in dental.

Patient navigation and financing is also undercapitalized, and will be an increasing area of need if more people lose dental insurance and as the elderly population (that is often uninsured) increases.

Preventative education, care, and monitoring that providers can use to reach consumers and care providers outside of routine visits. This is especially important given that so many dental procedures (e.g., cavities) are entirely preventable.

Diagnostics and treatments are still in relatively short supply, and it’s a different investor set that would likely come in and fund these as technology, digital health and software investors are oftentimes less likely to invest in companies that face some level of regulatory risk.

Practice Management

Treatment

Diagnostics

Consumer Products & Services

Care Delivery & Coverage

Design credit: Zoe Lammer

Why investors haven’t piled in - yet

The team at 7wire Ventures, a digital health-focused fund, has been looking at the oral health space for years now. What’s held them and other investors back? Well, there’s a few reasons, some that might be obvious and others less so.

The first is that for decades, dental practices in the U.S. tended to be “mom and pop” stores embedded in local communities. That’s been changing as more private equity firms have swooped in, making more and more offices part of conglomerates and chains. That’s opened up opportunities to sell software into dental practices, whereas previously investors may have viewed this opportunity as far too slow and niche.

Another is more cultural. Lee Shapiro and Tiffany Yu from 7wire made the astute point that investors have historically treated behavioral health and dental as separate from physical health, even as the public health world has been seeking to expand the definition of “health” to include all of the above - including in how we reimburse for prevention, treatment and other services.

There’s also the question of the go-to-market. Dental has often been considered the purview of more consumer-focused investors given that there’s a strong cash pay element to it. “There is limited Medicaid and Medicare coverage for dental procedures,” noted Yu and Shapiro. “There has been a sentiment that dental care is more direct-to-consumer because the out-of-pocket cost tends to be larger.”

Another issue, according to investors I spoke with, is the concern that oral health startups often face challenges getting funding beyond the series A. That might make early-stage VCs hesitant to back these companies if they’re concerned they can’t make it through the growth stage and ultimately to a big exit.

Getting investors around the table

Very few VCs and private equity shops have made plays in that expanded vision of oral health that includes prevention and ties in dental with other forms of health care including primary care, chronic disease management and even longevity.

Where most of the money has gone thus far is in orthodontics and orthopedics, cosmetics, other consumer-focused products and chains of physical clinics. Some of the most notable companies that have been backed by VC and PE include Overjet (dental AI software), InBrace (AI-powered teeth straightening), and more. Not all the big venture bets have proven successful. SmileDirectClub filed for bankruptcy in 2023 after struggling to turn a profit. Because much of dental is paid for out-of-pocket - between 40% and 100% - it makes these consumer plays more appealing to investors. The market doesn’t expect to be able to use insurance, particularly if some aspect of the benefit is aesthetic, relative to other areas of health care.

What does the data tell us? As with all other areas of healthcare, CareQuest’s analysis of Pitchbook data found that venture funding into the sector peaked in 2021. Those were some heady times, given low interest rates and investors viewing the pandemic as a catalyst for telehealth and other innovations in healthcare. The market has leveled out since, in part due to interest rates increasing and limited partners allocating less capital to the asset class.

Where the bright spots seem to be is in the increasing interest in dental amongst traditional health VCs, and also corporate venture funds. There’s increasingly rounds getting done at the early stages, although growth-stage capital has been harder to come by. Via CareQuest Innovation Partners’ analysis of Pitchbook data, seed investing in oral health is starting to spike, but there’s historically been very little appetite at the series D stage and beyond - although things have started to pick up in recent years. I suspect a major reason for that is that oral health hasn’t seen quite the same valuation spike as telehealth and other areas of digital health experienced, making it more feasible for growth-stage investors. Many of the top firms have told me in the past few months that they’re struggling to deploy capital, given the valuation problem. If the private markets and public markets are wildly out of sync, growth-stage investors will be the most likely to be underwater when the company exits.

Per the data, seed continues to crush by volume while funding becomes more challenging for companies to come by at the Series B and C. That mirrors other sectors, including healthcare. That said, funding does appear to be getting more stable for Series D and beyond over time, particularly given ongoing interest from corporate venture funds and some traditional healthcare investors.

Expanding beyond dental

Many of the insiders I spoke to for this piece refer to the market as “oral health” and not just dentistry. It’s to connote the bigger problem beyond just teeth. Gum disease, for instance, has more than a dozen comorbidities, meaning it’s linked to lots of other conditions, including cardiovascular disease, type 2 diabetes, obesity, certain cancers and more. Because so few young people these days have a family doctor they see regularly, there could be an enhanced role that the dentist and their team could play during screenings in identifying potential issues and routing patients to the right place. Beyond screenings, there’s also reasons to keep the teeth and gums healthy to better prevent the onset of disease. That could be particularly important for pediatric populations, particularly if RFK Jr. continues with his war on fluoride.

As a result, the 7wire team is keeping an eye on investing in companies that would address the access gap and all the disparities in dental. If there’s a way to get more people to access care, that would clearly improve the person’s overall health and go a long way towards prevention. That might include dental insurance - and I have seen companies emerge here including Flossy and Bento Dental.

Per 7wire, there’s also opportunities to drive down cost, particularly given that so much of dental is still out-of-pocket. It’s a prepaid capped benefit, which makes it distinct from other forms of insurance and also more likely to result in cash pay. One example of that might be in at-home aligners, which could save a patient trips to the dental office but also provide a cheaper price-point. Beyond insurance, there’s also companies building innovative financing solutions to help close the gap, such as Cherry and CareCredit. Firms I spoke to are also keeping an eye on subscription plans and membership-based dental practices, like Wally and Boomcloud . Within the consumer segment, another trend involves tele-dental and mobile dental clinics that are super convenient for consumers, such as ExcelHealth, JetDental, and Enable Denta (a portfolio company for CareQuest). All in, these companies share a goal in making oral health more accessible and affordable for people, even in scenarios where it remains an out-of-pocket cost.

One of the areas I’m keeping an eye on in the space I’d define as technologies that are simply really cool. Katie D’Amico, who meets with hundreds of startups a year, described seeing mouth pieces that brush an individual’s teeth on their own (in theory, we should all be able to brush our own teeth, but a lot of us don’t do so thoroughly enough). A wearable salivary diagnostic for continuous health monitoring. Or allergy desensitizing toothpaste. There will continue to be innovations here, particularly given rapid advancements in AI and robotics.

A final note on fluoride

Even as we make big strides when it comes to oral health, we could slide backwards if the current administration continues to push to remove fluoride from water. Public health experts have shared many times that fluoride has passively protected the teeth – including from cavities – of millions of Americans for decades, making it one of the twentieth centuries’ greatest achievements.

We have some sense of what might happen if fluoride is banned as we’ve seen this play out before. Per Burroughs, fluoride still isn’t used in any Hawaiian community water systems and a 2015 report found the state had the highest rate of tooth decay among children in the nation and continues to have some of the worst oral health of any state. Another study from 2022, compared the cost of children’s dental treatments in two Alaska cities, Juneau and Anchorage. After Juneau ended fluoridation, costs for tooth decay treatments rose to nearly nine times more than those in Anchorage.

Bottom line: If this ban comes to pass, the need for increased investment in oral health will only become more urgent.

Want to support Second Opinion?

📧 PLEASE PLEASE PLEASE Share this email with other friends in the healthcare space! A lot of our newsletter is free, and we’d love to engaged as many smart readers as possible.

🌟 Leave a review for the Second Opinion Podcast

💵 Become a paid subscriber and get access to even more content.

📢 Become a sponsor