Special thanks to our friends at Ambience Healthcare, who have made this post free to all users as part of sponsoring Second Opinion.

Ambience Healthcare is the leading AI platform for clinical documentation and coding—trusted by top health systems like Cleveland Clinic, UCSF Health, St. Luke’s Health System, and Houston Methodist.

In partnership with KLAS Research and St. Luke’s Health System, Ambience also just published a breakthrough impact report, detailing how St. Luke’s is leveraging Ambience’s AI platform to reduce documentation time and clinician burnout, while improving documentation accuracy and revenue integrity (generating more than $13K annually per clinician).

Longevity is a booming category of healthcare, and the companies in the space are gaining traction. But it still elicits mixed reviews from clinicians, given the lack of studies to backup the approach. Some believe it’s mostly an intervention for the so-called “worried well,” who are willing to pay to optimize their health, despite being generally healthy. Others view it as a fresh spin on primary care and prevention, one that patients are willing to pay for out-of-pocket — and therefore worthy of greater exploration and even investment. I tend to take a broader view, and believe that longevity investments are critical to a world in crisis with rising rates of chronic disease and a population that is getting older and sicker.

Healthcare investors are seeing potential too, particularly given the rapid growth that companies like Function Health, Superpower and Lifeforce have seen. But how do firms view the opportunity here, now that some of the big bets have been made? Function Health is already valued at $2.5 billion, as of February of this year. And Superpower just raised $30 million. Given that, where are firms looking to make investments going forward?

7wireVentures, based in Chicago, has been digging into the space over the past few years, culminating in a deck shared with its own limited partners about the longevity market. The firm agreed to share the full presentation with Second Opinion readers exclusively, in the hopes that it would inform all of our collective thinking and provoke some interesting discussion. Download the full deck below.

The Perfect Storm

The investors at 7wire view longevity in the context of a broader set of trends.

The first is the growing consumer desire not just to live longer, but to live better. Many of the longevity services offer insights related to biological age as opposed to chronological age. A good friend of mine, who eats extremely well and regularly works out, just learned via one of these longevity companies that she may be 42 according to her birth date, but may be aging more slowly than that. This may seem like a marketing ploy to share with a forty-something that they have the metabolism and health of a thirty-something, but I’d argue it’s an effective mechanism for clinicians to talk to patients about the way they’re living their lives, and the impact that behavior change may have on their life span.

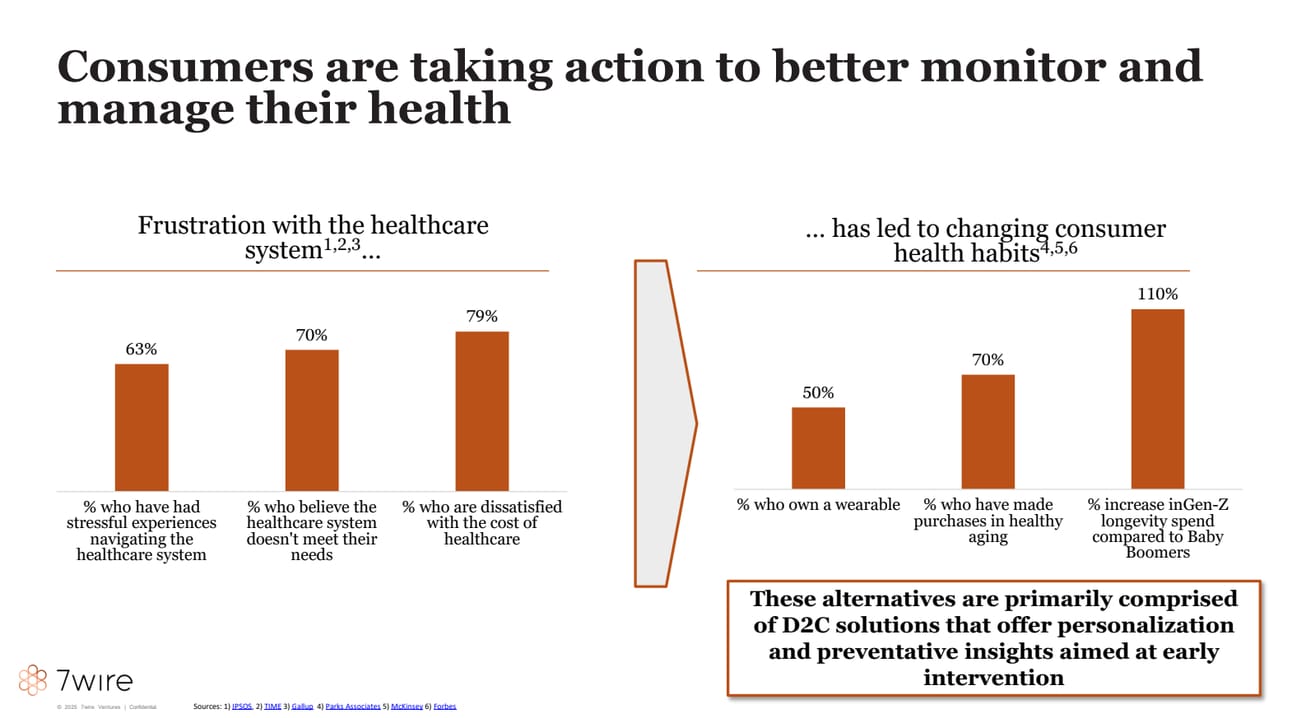

Another factor is the well-cited consumerization of healthcare trend, as people become more motivated to take on their own healthcare outside of a physicians’ office. This is manifesting in a few ways. More consumers seem to be adopting wearables these days, and there’s widespread interest in supplements, health foods, and medicines that support improvements in metabolic health. This appears to be generational, per the 7wire presentation, with millennials embracing these trends far more so than Baby Boomers. It’s also in the political zeitgeist right now, given Health Secretary Robert F. Kennedy Jr’s push to promote consumer health wearables to the broader population of Americans.

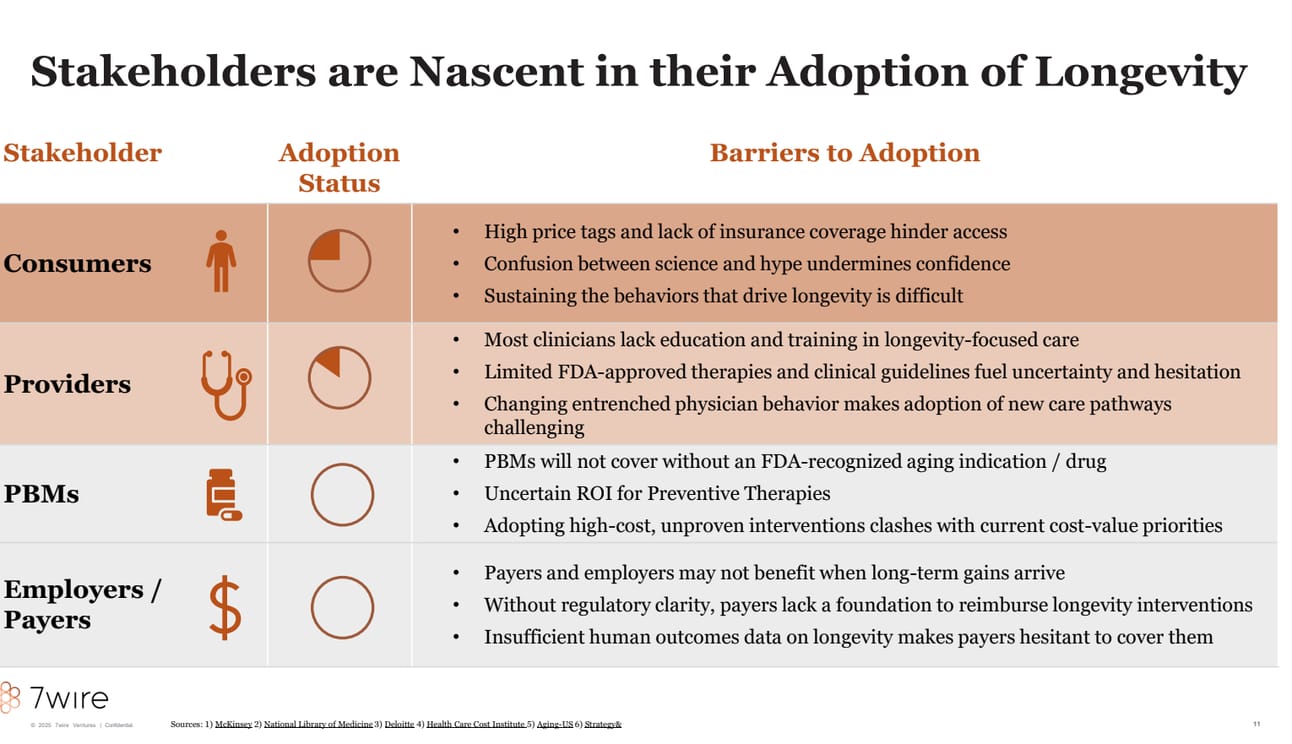

There are critics of the longevity sector that view it as a niche. But 7wire is just one of the funds I’ve spoken with recently that believes it’s early on an adoption curve — and therefore hard to tell what the total addressable market may be for these services and solutions. One of the other issues is that it still remains heavily out-of-pocket, so few healthplans and employer stakeholders and are reimbursing for it. To really spur adoption, it would require better financial incentives related to longer-term health outcomes. Currently, it is extremely challenging to get reimbursed for prevention because of the “churn” problem. In the mindset of payers, why solve a problem when a competitor will benefit from the improved outcomes down the line?

I’d also argue that there’s a fourth category here - the “influencer.” I believe that longevity is the trend that is bringing in influencers in other areas, like entertainment and consumer, and getting them more involved in health and medical trends. That could bring some of the medical staffing companies more deeply into the space, like Wheel and OpenLoop, as more influencers offer medical services staffed by clinical teams - not just over-the-counter wellness and supplements. Where the influencers come in would be in supporting patient acquisition.

There may also be opportunities, not included in depth in the deck, related to software and SaaS that sells into these clinics. It’s a tricky thing to determine how many true longevity clinics have already popped up, although I’ve seen estimates that it may already be in the hundreds if not thousands in the U.S. alone. But there’s longevity-like principles seeming into independent practices, concierge practices and more, and companies like Hint Health and Vibrant Practice popping up to serve them. It’s not just about creating an electronic medical record, but also about the commerce activities that many of these clinics provide.

Regulatory changes will also be needed. Policymakers must start viewing aging as a treatable condition, not just a natural inevitability. That shift could theoretically unlock a wave of scientific discovery and funding. That would lead to the potential development and commercialization of safe and effective longevity solutions. There are also ethical concerns about the lack of equitable access to these solutions, particularly given that high out-of-pocket cost, and a lack of clinical evidence to demonstrate that these solutions work. The fix, via 7wire, is rigorous and transparent clinical research, coupled with designing ethical principles in longevity product development.

New Technologies

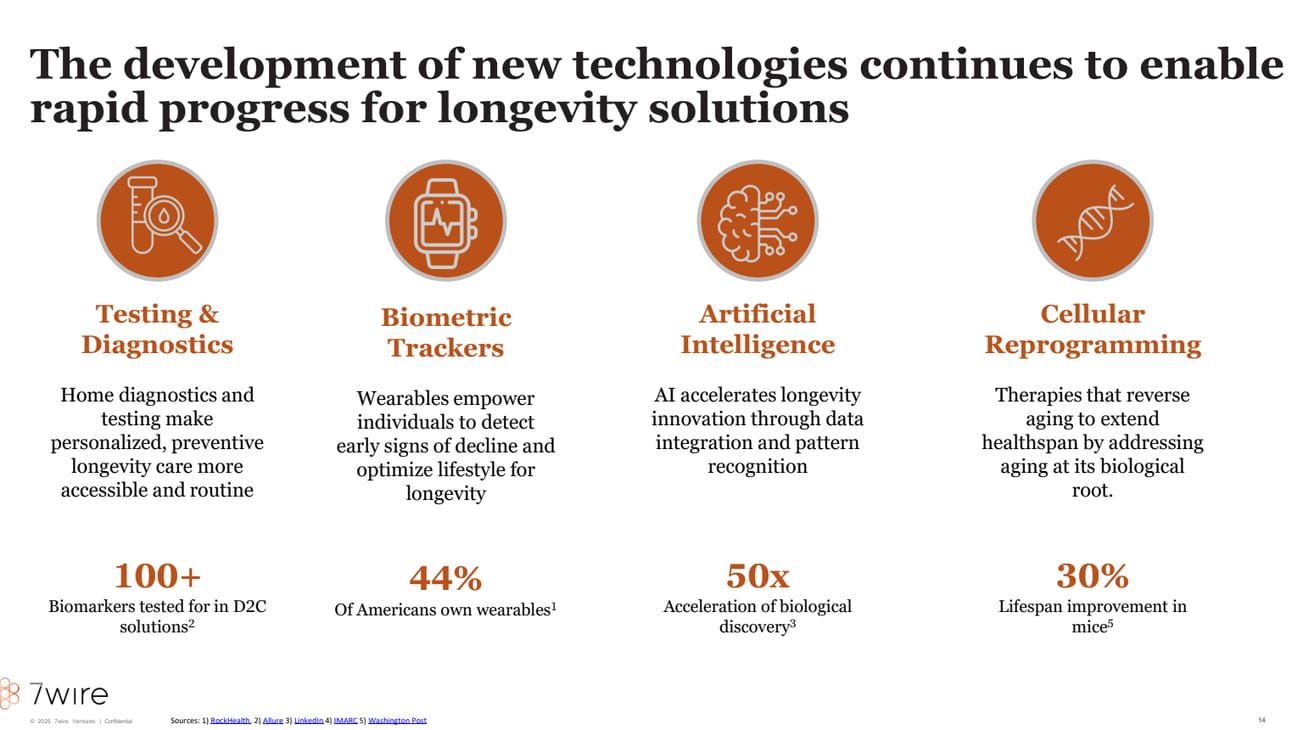

In its research, 7wire identified four big technology drivers that may play a huge role in spurring adoption of longevity solutions, including consumer wearables and new therapeutics. I think they’ve nailed the four main categories, and I’m paying special attention to scientific developments that may fuel the adoption of wearables. There have been rumors for years, for instance, about wearable makers developing technologies to non-invasively and continuously track blood sugar, for instance. Generative AI, theoretically, could bolster some of this research.

7wire’s investment team provided case studies for each of the categories included above, such as Function Health in the testing and diagnostics area. Take a look at the full presentation linked above to view them.

Market Segments

The team put together a useful market map that provides an overview of the longevity businesses that have raised venture capital. The area with the most competition is age-tech and cognitive health, followed by consumer diagnostics and care. Where there may be opportunity is in therapeutics and drug discovery, as well as cellular rejuvenation - both areas that are still nascent in terms of funding. Overall, the thesis is this market is piping hot but there’s still far more potential for winners here, particularly given the overall TAM.

Note: This map is consumer-facing, so I’d love to work with a venture firm that wants to tackle the provider-facing or enterprise-facing companies that are sprouting up in longevity, inclusive of all the PE-backed rollups we’re now seeing.

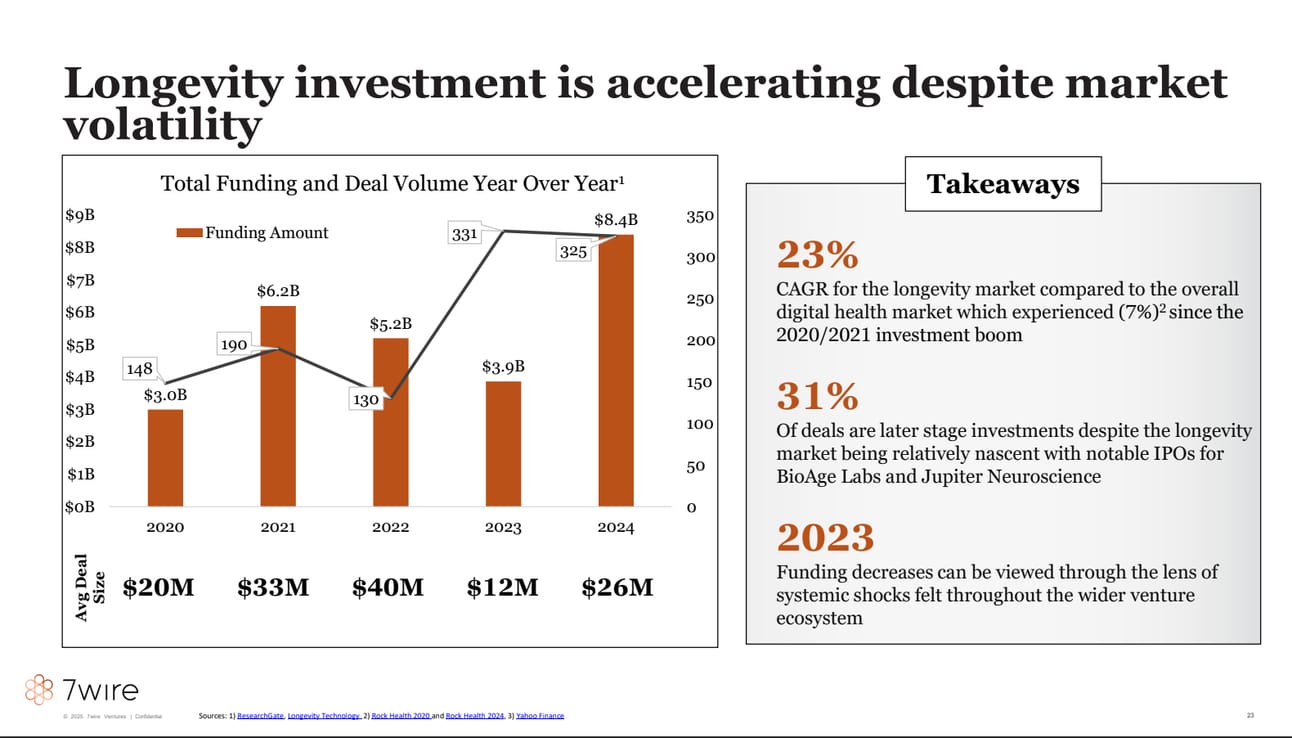

Indeed, investing in longevity has continued, even though the market is down overall. 2024 was the biggest year yet for longevity investment dollars, while in most other categories of health care, it was a slow year relative to 2020 and 2021. We may not have hit peak investment frenzy in the longevity category, particularly given the continuing momentum in the sector and the rapid revenue ramp that many of these companies are seeing.

This deck is LP-facing, so 7wire has highlighted a few of its portfolio companies, including Homethrive and Parsley Health.

What I found most interesting is the potential tie-in here to the AgeTech category, which I also believe is highly investable and has not received sufficient funding. Many of us think of longevity as really a preoccupation for younger, healthy individuals - but venture firms see a big opportunity here to bring these solutions to those who are aging but still desire independence and a high quality of life.

Where I also see potential is to develop longevity solutions that specifically target women, given that so many of these companies lean male-heavy in their demographics and have launched campaigns with influencers that are popular with men. Focusing on men actually makes a lot of sense, given that this demographic tends to avoid going to the doctor at higher rates than women. But I do still see a ton of opportunity related to areas like perimenopause and menopause to specifically engage women.

VC firms: I’m constantly scouting fresh thinking in this space—and want to hear from you. I’m looking for a level of detail here, and to understand what you really think. So if you’ve got something that you’re proud of, we’d love to take a look! Reach out to me at [email protected].

Want to support Second Opinion?

📧 Share this email with other friends in the healthcare space!

💵 Become a paid subscriber!

📢 Become a sponsor

🌟 Leave a review for the Second Opinion Podcast